Negative gearing depreciation calculator

Negative gearing may have resulted from financial costs to keep the property or from depreciation on the property. 03 9005 5762.

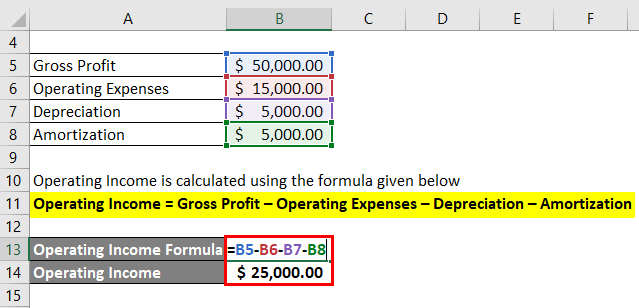

Salvage Value Formula Calculator Excel Template

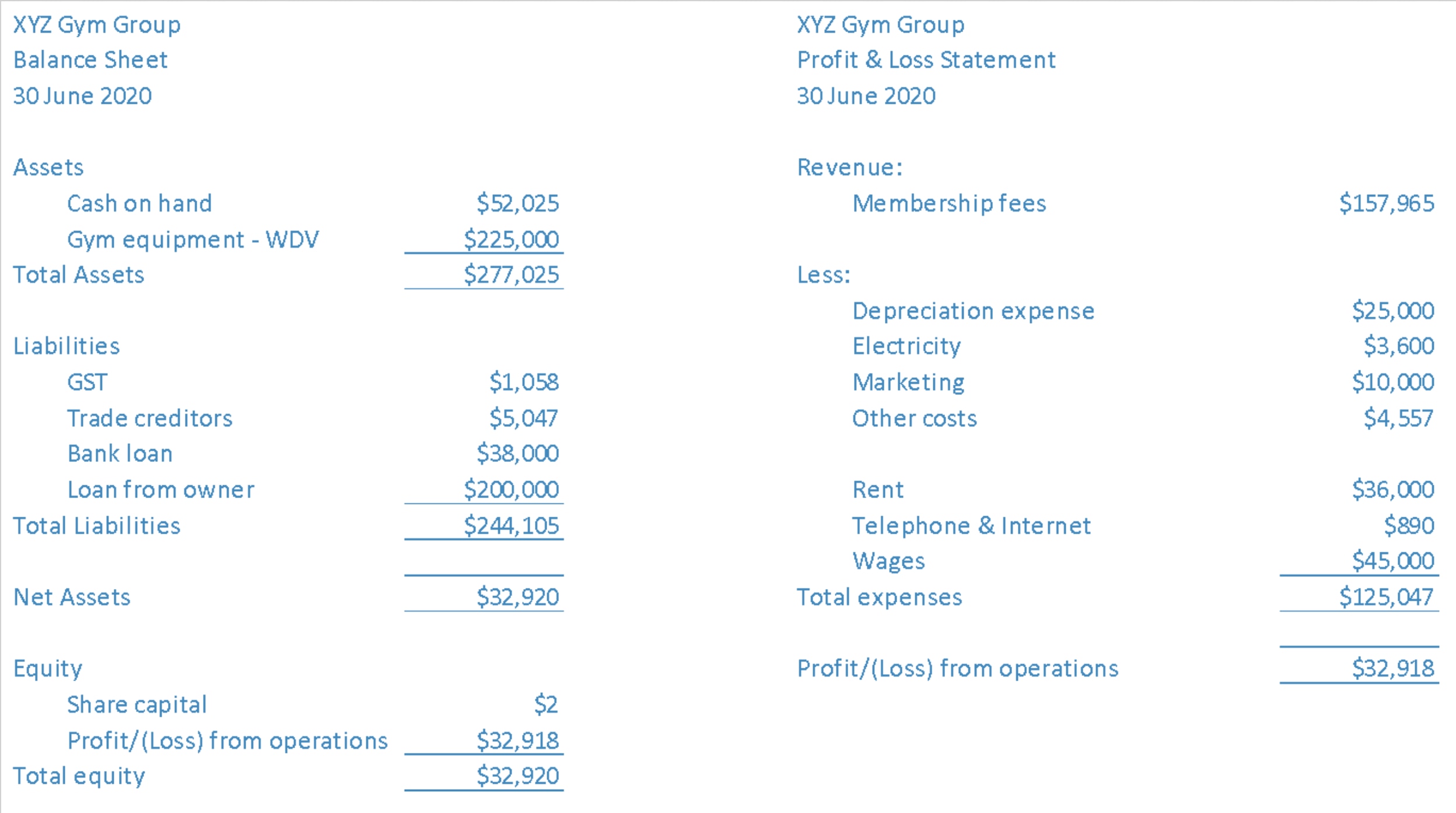

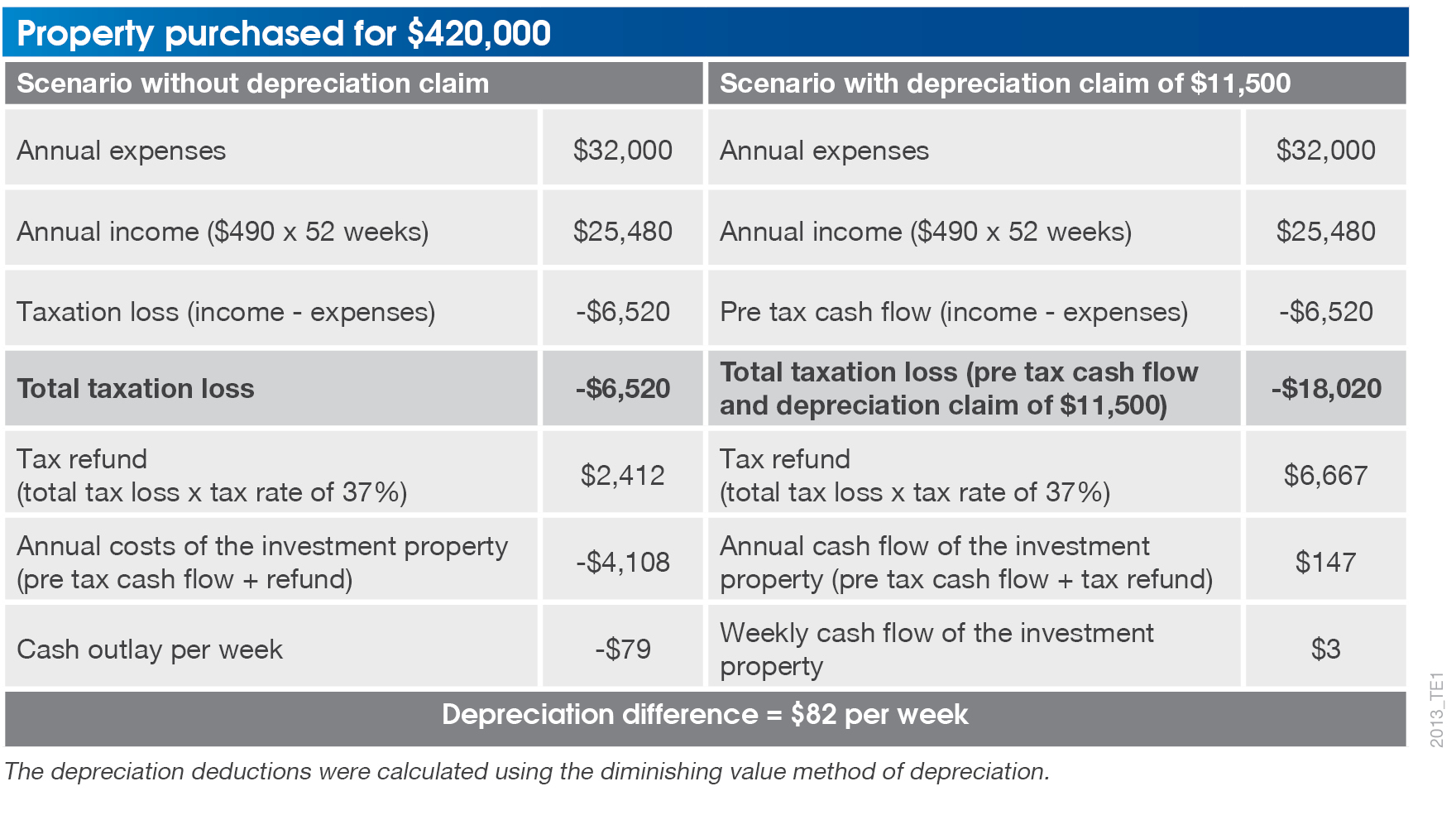

How claiming depreciation affects cash flow for a negatively geared property.

. If youre not sure how much rent. Conceptually depreciation is the reduction in the value of an asset over time due to elements such as wear and tear. Depreciation and negative gearing.

The key benefit of negative gearing is that any net rental loss you incur during the financial year may be offset against other income you earn such as your salary. Our Negative gearing calculator allows you to obtain an estimate of potential tax benefit of buying an invetsment property. Property is still cash flow negative 15975 every month.

Negative gearing calculator Our negative gearing calculator can give property investors an estimate of the tax benefits they could receive based on the following information. Capital Claims Tax Depreciation are quantity surveyors and investment property depreciation experts. Depreciation Estimated 8000 in depreciation Tax Refund 325 468260 13408 x 0325 Cash Flow After Tax -1395 week or -72540 year So as you can see in this.

Negative Gearing Calculator Negative Gearing simply means investing in a property that has greater expenses than its income. This reduces your taxable. Our Negative Gearing Calculator is simple to use and provides you with the after tax out of pocket cost per week and the years to positive cashflow.

Given that depreciation is a non-cash deduction it can turn a positively geared property into a negatively geared one without making. The cash flow calculator needs to know your taxable income so that it can work out the benefits you may receive from depreciation and negative gearing. For new properties we can also deduct.

Use our negative gearing calculator to work out the profit or loss from your investment property as well as your tax refund from negative gearing. It means there must be some way to feed the cash flow losses from income or cash sources over and. Given that depreciation is a non-cash deduction it can turn a positively geared property into a negatively geared one without making.

There are three rental expense categories those for which you. Now cash flow positive 19266 every month - a. Can claim a deduction now in the income year you incur the expense for example interest on.

For instance a widget-making machine is said to. Either way the cost to own an investment property will. Negative gearing by property investors reduced personal income tax revenue in Australia by 600 million in the 2001-02 tax year 39 billion in 2004-05 and 132 billion in 2010-11.

This creates an ongoing deficit that you might need to pay. Depreciation and negative gearing. Learn more about how depreciation improves investor cash flow here.

Negative gearing is by definition negative even after the tax benefit.

Tax Depreciation Schedules Australia Have Quantity Surveyors Who Are Professional Yet Dedicated Who Realize Someth Being A Landlord Investing Property Investor

Negatively Geared Does Not Mean Cash Flow Negative

Investment Property Depreciation Brand New Vs Established Properties

Salvage Value Formula Calculator Excel Template

Tax Depreciation Schedules Australia Have Quantity Surveyors Who Are Professional Yet Dedicated Who Realize Someth Being A Landlord Investing Property Investor

Calculate Depreciation In Excel With Sln Straight Line Method By Learnin Learning Centers Excel Tutorials Excel

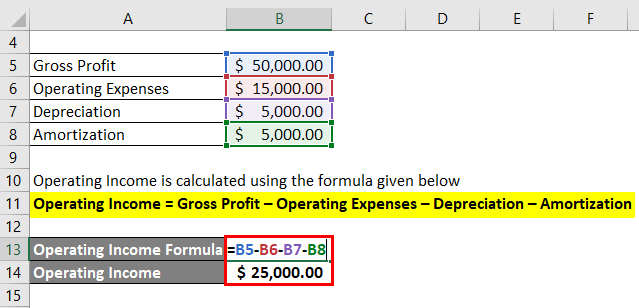

Operating Income Formula Calculator Excel Template

Salvage Value Formula Calculator Excel Template

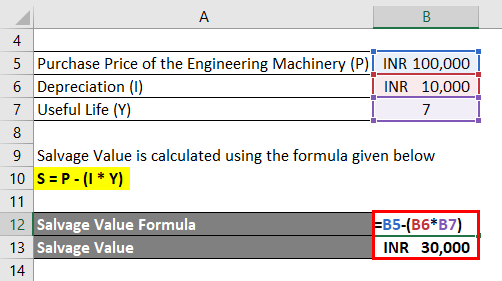

Solvency Ratio Formula Calculator Excel Template

How To Calculate Depreciation On A Car Hot Sale 58 Off Www Ingeniovirtual Com

Negative Gearing Is A Depreciation Report Still Relevant

Accounting Vs Tax Depreciation Why Do Both Quickbooks

Depreciation And Off The Plan Properties Bmt Insider

Student Rental Property Owners Depreciation Bmt Insider

Tax Depreciation Deductions Claim For New Investment Property

Salvage Value Formula Calculator Excel Template

![]()

Tax Depreciation Schedules Australia Have Quantity Surveyors Who Are Professional Yet Dedicated Who Realize Someth Being A Landlord Investing Property Investor