Tax on sale of rental property calculator

Please use the investment property calculator only for the building and Others calculator for the land because building is a depreciable property and land is not. If I bought for 250k and sell for 400k would I pay the tax on 50 profit of the.

Pin On Airbnb

Use this tool to estimate capital gains taxes you may owe after selling an investment property.

. APIs Capital Gain Tax Calculator to calculate taxable gain and avoid paying taxes by taking advantage of IRC Section 1031. Depreciation recapture tax rates. Your rental earnings are 18000.

This calculator will help you estimate your capital gains tax exposure and the net proceeds from the sale of your asset investment property or otherwise. Selling Price of Rental Property - Adjusted Cost Basis. 2022 Capital Gains Tax Calculator.

Once you know what your gain on the property is you can calculate if you need to report and pay Capital Gains Tax. This handy calculator helps you avoid tedious number. The tax rate can vary from 0 to.

Capital Gains x Tax Rate Depreciation x 25 Tax Rate. You cannot use the calculator if you. Your investment property appreciates over time.

I had a quick question on calculating capital gains tax on the sale of a rental property. If your taxable income is 496600 or more the capital gains rate increases to 20. You collect rent monthly.

To calculate the capital gain and capital gains tax liability subtract your adjusted basis from the sales price of the property then multiply by the applicable long-term capital. For a married couple filing jointly with a taxable income of 280000 and capital gains of. Rental property provides an investor with several potential passive income streams.

As a result your taxable rental income will be. Rental income tax breakdown. It was updated in 2013 to reflect.

Work out if you need to pay. This capital gains tax calculator estimates your real estate capital gains tax plus analyzes a 1031 like-kind exchange versus a taxable sale for benefit financial mentor. You earn equity in your home.

You can claim 1000 as a tax-free property allowance. Since depreciation recapture is taxed as ordinary income as opposed to capital gains your depreciation recapture tax rate is going to be your.

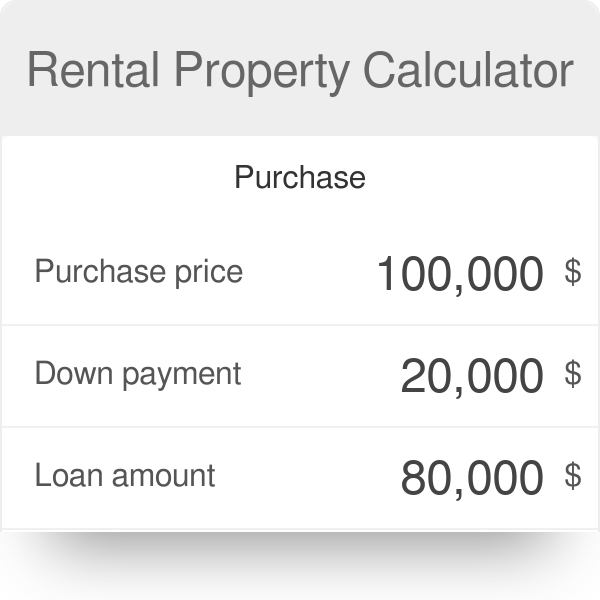

Rental Property Calculator Forecast Your Rental Property Roi

Calculating Returns For A Rental Property Xelplus Leila Gharani

Calculating Returns For A Rental Property Xelplus Leila Gharani

Rental Property Calculator How To Calculate Roi

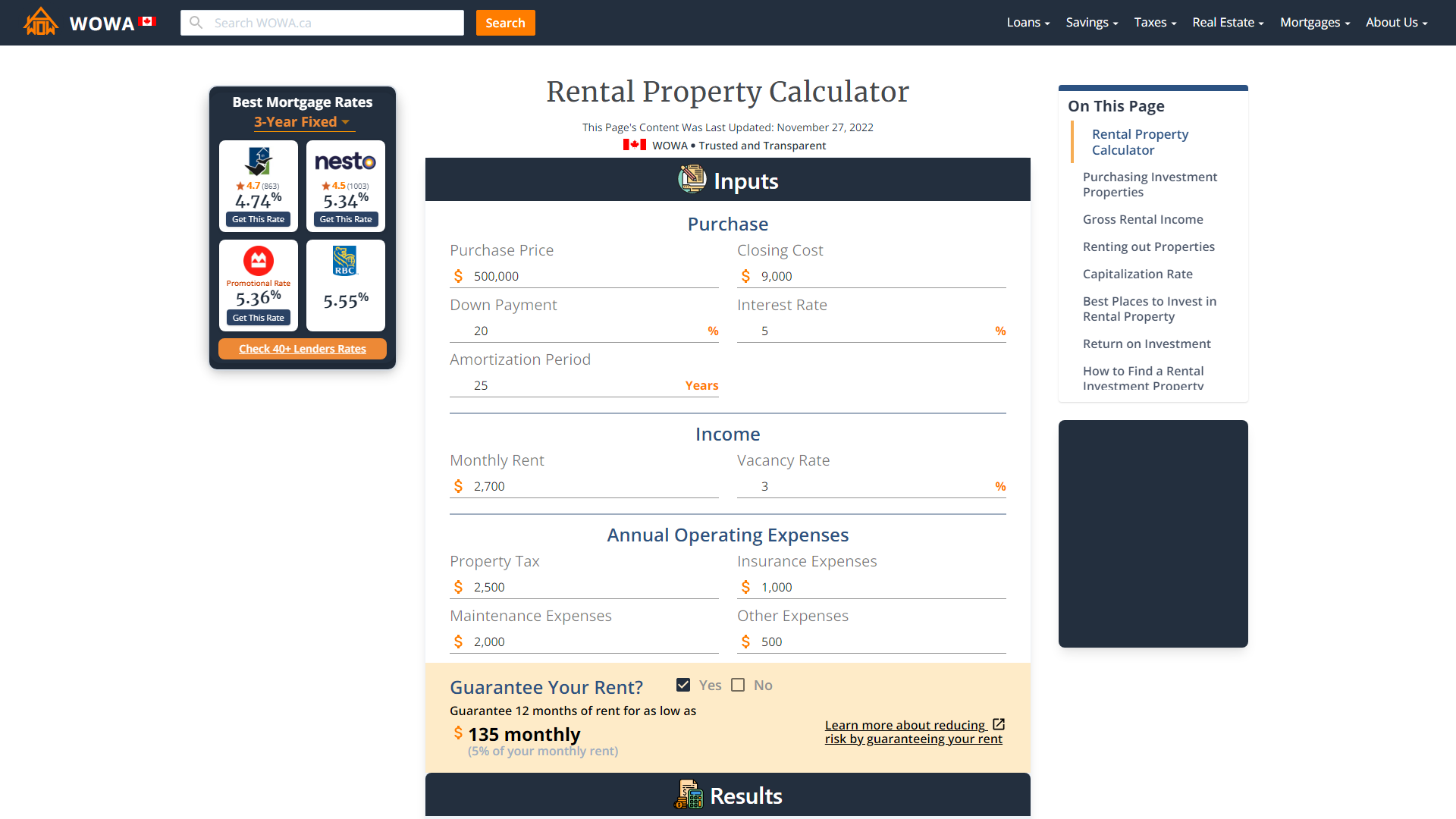

Rental Property Calculator Most Accurate Forecast

Rental Property Calculator Most Accurate Forecast

Lzbw6a1vckffem

Calculating Returns For A Rental Property Xelplus Leila Gharani

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

How To Calculate Rental Income The Right Way Smartmove

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

Tax Calculator For Rental Property Cheap Sale 57 Off Www Ingeniovirtual Com

Rental Property Calculator Most Accurate Forecast

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Investing Rental Property Calculator Mls Mortgage Real Estate Investing Rental Property Rental Property Management Real Estate Rentals

Calculating Returns For A Rental Property Xelplus Leila Gharani

7max Taf7cdbem