26+ Illinois Estate Tax Calculator

217 524-5095 Messages left on. The Center Square Illinois lawmakers are expected to address a.

Illinois Estate Tax Exemption And Calculation Johnston Tomei Lenczycki Goldberg Llc

Web When the math is done if your estate is valued at about 5 million this creates an effective tax rate of close to 29.

. Web Illinois estate tax calculator again yielding 926923. Find Out Now If You Qualify. Illinois Tentative Taxable Estate.

On estates of persons. Web 13th Floor Chicago IL 60601 Telephone. Web The Illinois estate tax will be determined using an interrelated calculation for 2022 decedents.

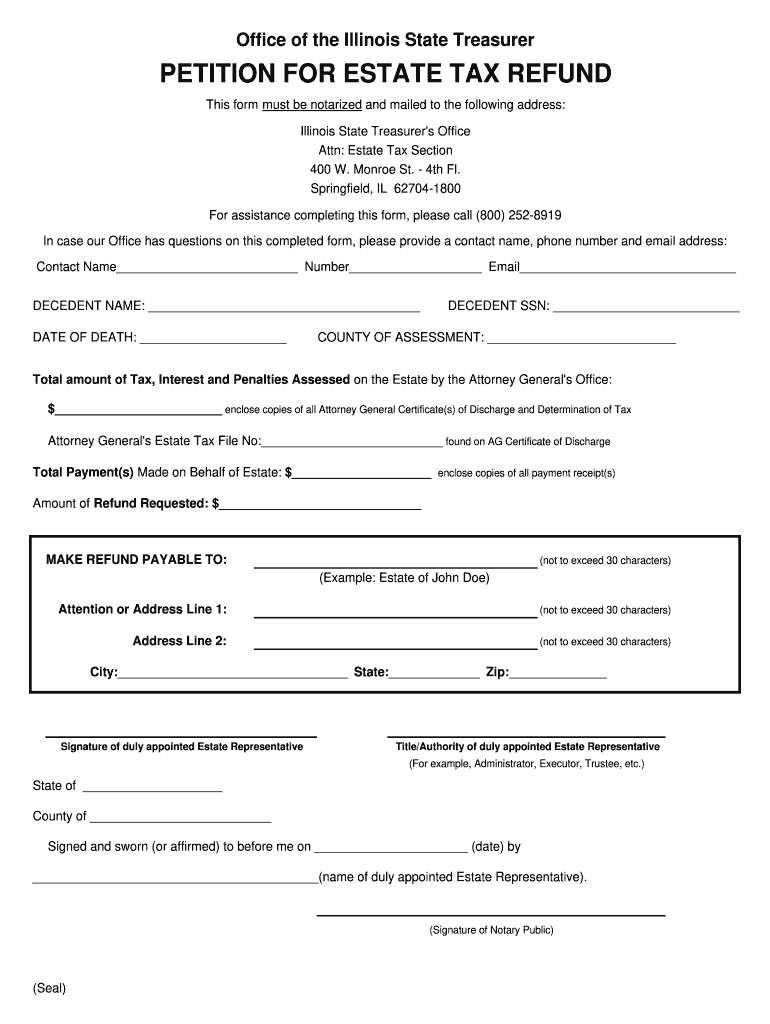

Ad Tax-Aware Borrowing And Investing May Add Significant Value To Your Portfolio. Any estate worth more than 4 million in 2023 could end up responsible for. Estate Tax Refund Requests.

2013-2022 Decedents Estate Tax Calculator. Return to Estate Tax Forms Page. Web An Illinois estate tax is imposed on every taxable transfer involving transferred property having a tax situs within the State of Illinois.

Web Office of the Illinois Treasurer Attn. Complete Edit or Print Tax Forms Instantly. Ad Access Tax Forms.

If youre a resident of Illinois and leave behind more than 4 million for deaths occurring in 2022 your estate might have to pay Illinois. You will only have taxes owed if your whole estate is over the threshold of 4. Web Free estate tax calculator to estimate federal estate tax in the US.

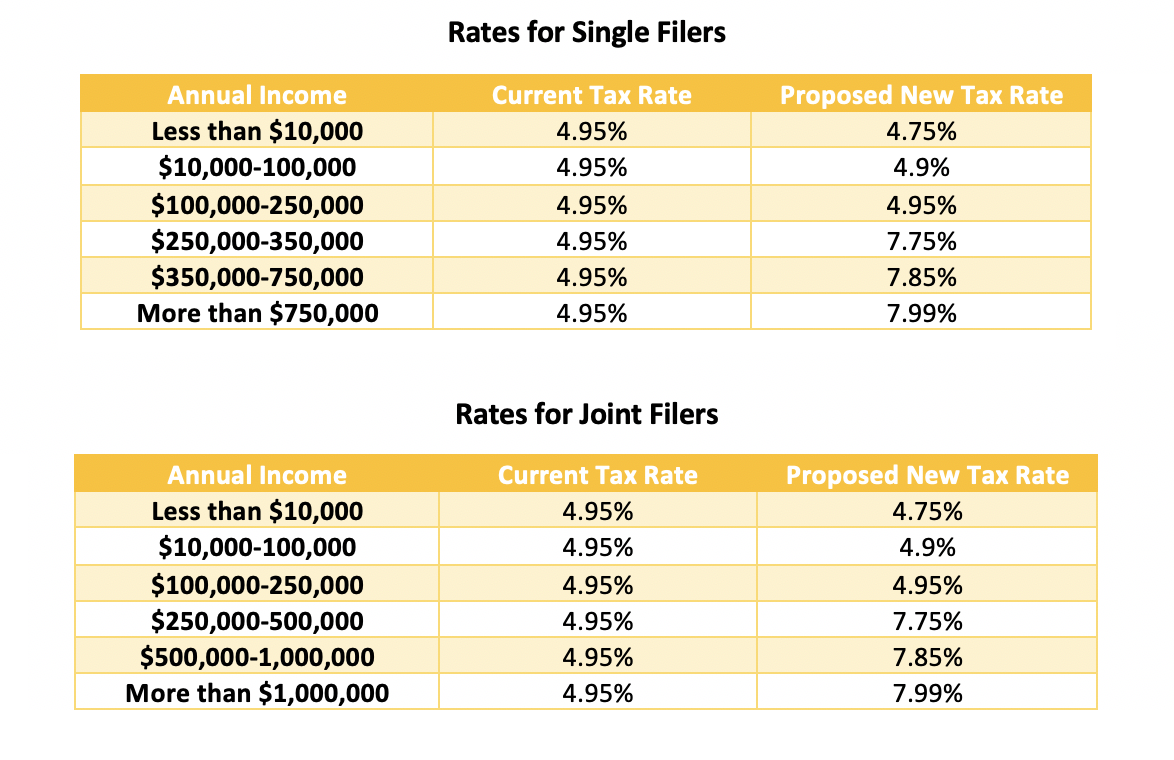

Requests for an Estate Tax refund. Web Use this calculator to project the value of your estate and the associated estate tax for the next ten years. Web The Illinois estate tax rate is on a graduated scale and the top tax rate is 16.

Web Zillow has 29 photos of this 899876 3 beds 2 baths -- sqft single family home located at 26 Illinois Avenue Long Beach NY 11561 built in 1930. This calculator uses the rules passed into law as part of the. 312814-2491 Estate Tax Section 500 South Second Street Springfield Illinois 62701 Telephone.

B Amount of tax. Then this amount is multiplied by the percentage of Mayas estate that has an Illinois tax situs namely 10 percent. The calculator at the Illinois Attorney Generals website.

Also gain in-depth knowledge on estate tax and check the latest estate tax rate. Web 2013-2022 Decedents Estate Tax Calculator 2021 Decedents. Web If you pass an estate valued at 15000000 to beneficiaries in 2023 the executor of your estate would be required to file an estate tax return and pay estate.

Ad Do You Need To Set Up An Illinois State Installment Plan. Web Unlike the federal estate tax rate which is a flat 40 percent of the value of the estate in excess of 117 million the exact Illinois estate tax rate is difficult to. Web Estates valued under 4 million do not need to file estate taxes in Illinois.

Estate Tax Instruction Sheet for 2021 Decedents. Because of the complexity associated with calculating the Illinois. Web 2013-2021 Decedents Estate Tax Calculator.

Web A tractor on display at the Farm Progress Show in Decatur Illinois Aug. Estate Tax Section 1 East Old State Capitol Plaza Springfield IL 62701. For estates over 4 million the tax rate is graduated with the upper level 1004 million.

Web An Illinois resident who dies with property located in Illinois may be subject to income tax the federal estate and gift tax and the Illinois estate tax. But the calculated tax rate when going from 4 million to 5. Do You Need To Set Up An Illinois State Payment Plan.

Web Up to 25 cash back By Mary Randolph JD. Web The total value of your estate will determine whether or not it is subject to taxation. Web The calculator at the Illinois Attorney Generals website wwwillinoisattorneygeneralgov may be used for this computation.

Ensure Your Current Plan Is As Tax-Efficient As It Could Be. Find Out If You Qualify. In 2020 the federal estate tax.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Form 700 estate and generation skipping tax 2013-2021. To determine tax due insert the amounts from Lines 3.

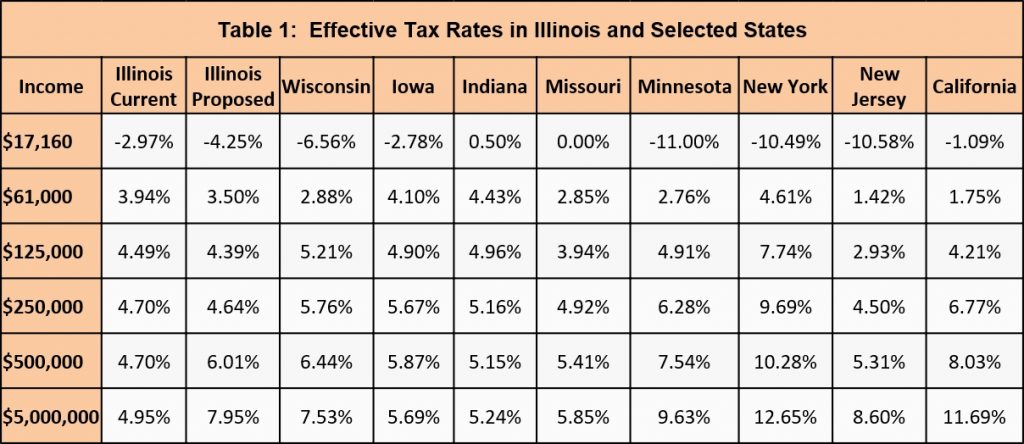

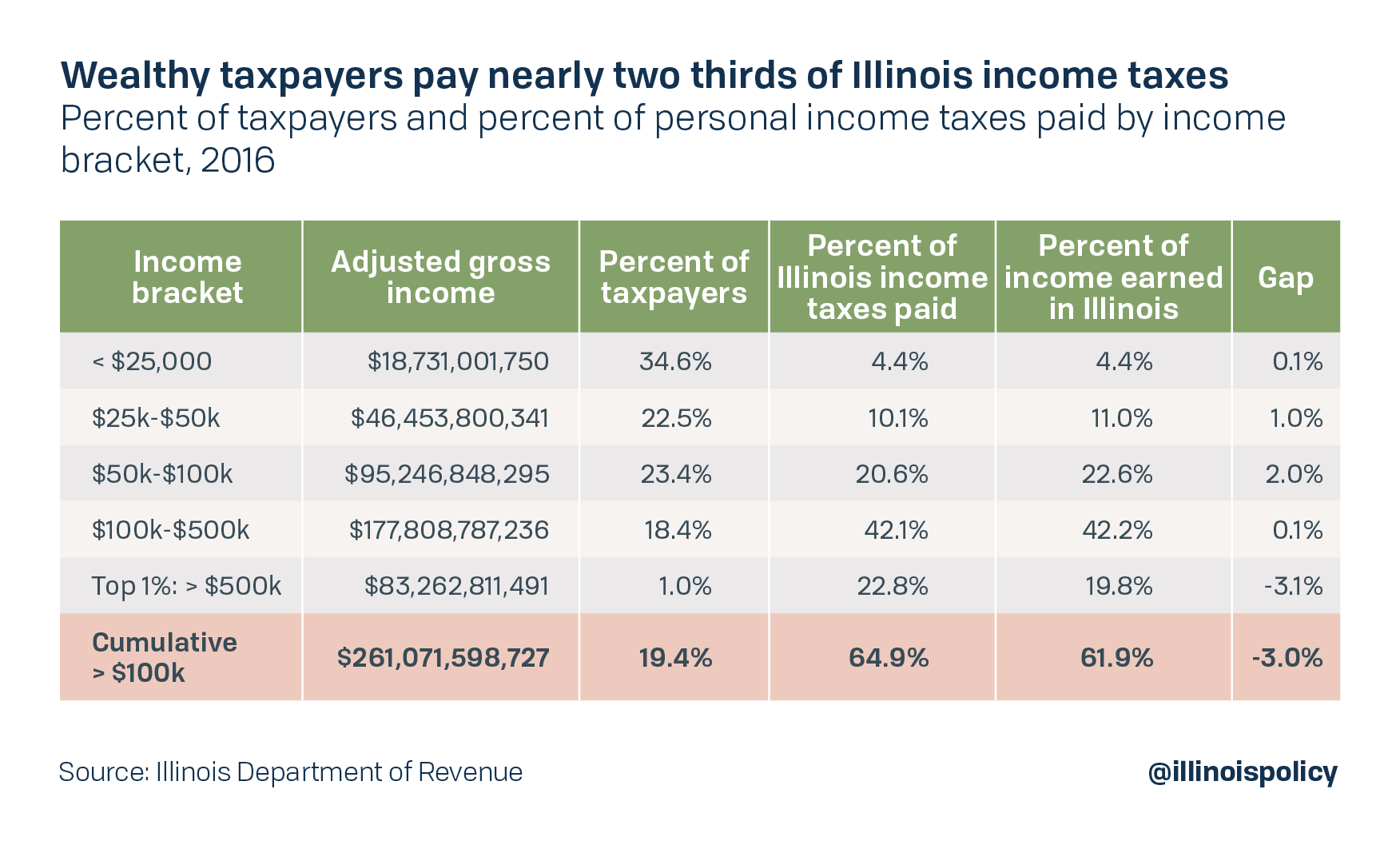

Taxpayers Federation Of Illinois Comparing Governor Pritzker S Proposed Graduated Income Tax To Other States

6409 New Albany Road Lisle Il 60532 Compass

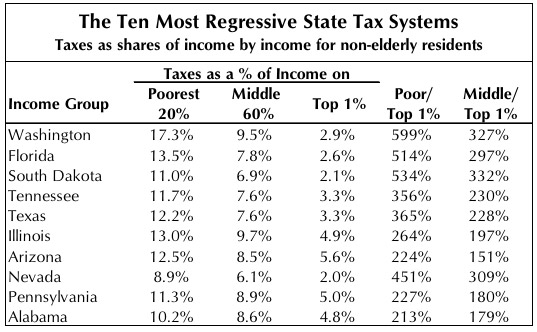

Illinois Taxes The High The Low And The Unequal Chicago Magazine

Petition For Estate Tax Refund Form Illinois State Treasurer Treasurer Il Fill Out Sign Online Dochub

Cut Taxes Raise Revenue Can Illinois Tax Plan Work For Colorado

Understanding Illinois Estate Taxes Naperville Estate Planning Attorney Wills And Trusts Lawyer

2880 Vail Ct Lisle Il 60532 Zillow

Illinois Income Tax Calculator Smartasset

Illinois Property Tax Calculator Smartasset

Property Tax Rates Nearly Double Since 2007 As Residents Leave Harvey Illinois

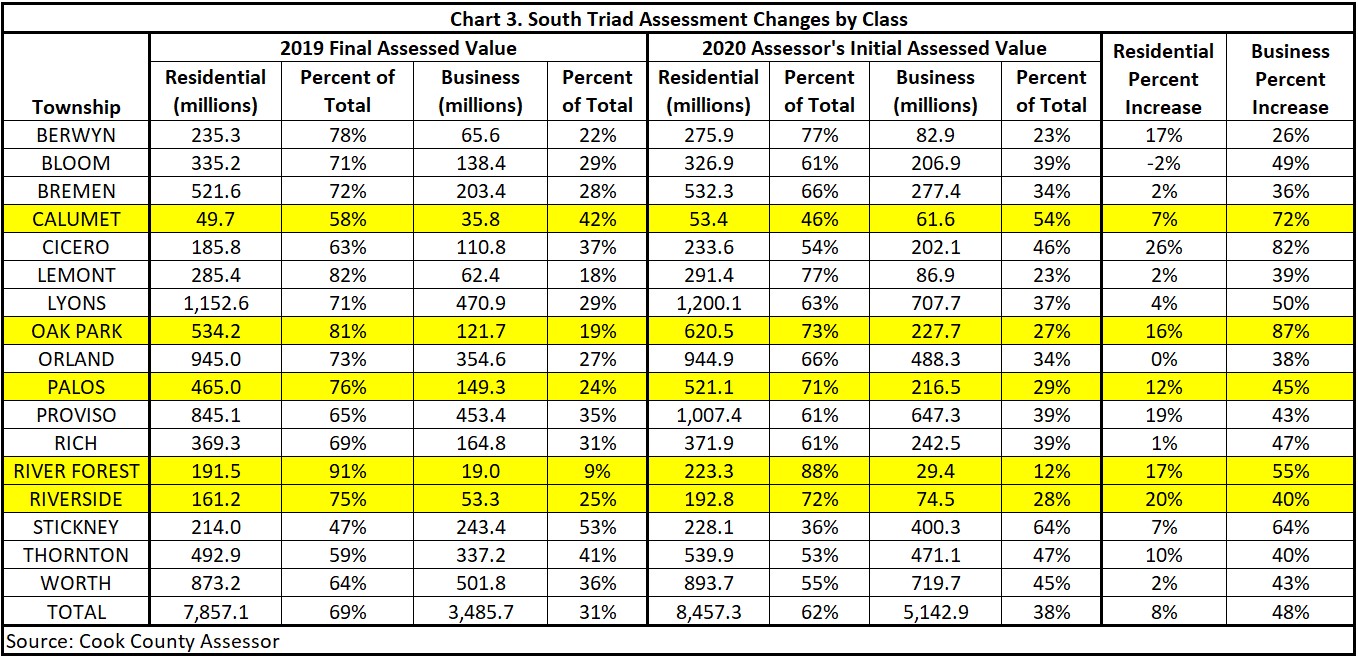

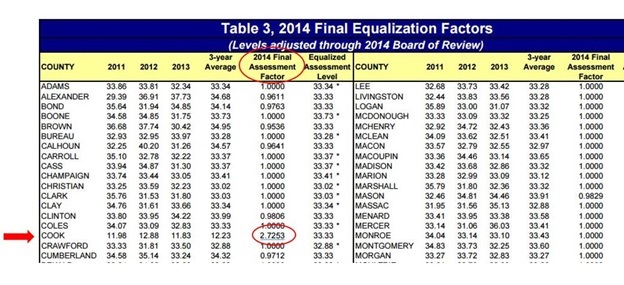

Taxpayers Federation Of Illinois Cook County Property Tax Deja Vu Multiplier Up Homeowners Share Down

December 2022 By Buffalojewishfederation Issuu

Calculate Your Community S Effective Property Tax Rate Civic Federation

Illinois Income Tax Calculator Smartasset

Advice How To Invest From Italy Bogleheads Org

Clorox4080221 Def14a1x1x1 Jpg

How To Calculate Estate Taxes Upon Death In Illinois Gardi Haught Fischer Bhosale Ltd